- Benzinga Future Finance

- Posts

- 😕 Rates Down, But Bitcoin Crashed To $108K

😕 Rates Down, But Bitcoin Crashed To $108K

Plus, JPMorgan is now tokenizing private equity.

Happy Thursday!

Bitcoin is tumbling again even though the Fed cut rates and Trump announced a trade deal with China: what is going on?

JPMorgan has tokenized a private equity fund, and JPM stock is now facing a crucial test at the $312 level: here’s what you need to know.

Plus, with markets moving fast following the rate cut, if you want access to the same toolkit top investors use to decode the chaos, check out Benzinga Edge.

TOP STORY

Bitcoin has plummeted below $109,000 after the expected Fed rate cut, prompting renewed debate over whether crypto traders once again fell for a “buy the rumor, sell the news” setup.

According to on-chain data provider Santiment, while the rate cut was widely expected, Jerome Powell’s hawkish tone during the post-meeting press conference rattled markets.

The Fed Chair cautioned that another cut in December isn’t guaranteed, citing persistent inflation and limited data visibility due to the ongoing government shutdown.

SPECIAL OFFER

Stocks just hit new highs as softer-than-expected inflation pressured the Fed to finally cut rates. But when markets move this fast, timing is everything. Now, you can access the same toolkit top investors use to decode the chaos, showing exactly when to strike, what to buy and why it matters.

QUICK N DIRTY

Bitcoin, Ethereum, Dogecoin are sliding following the Fed’s hawkish FOMC meeting: here’s what’s driving the market today.

Donald Trump’s pardon of Binance’s Changpeng Zhao continues to stir debate: did it follow a big stablecoin deal by Binance?

Tether now holds more U.S. debt than countries like South Korea and Germany: here’s what’s driving the growth.

SPECIAL OFFER

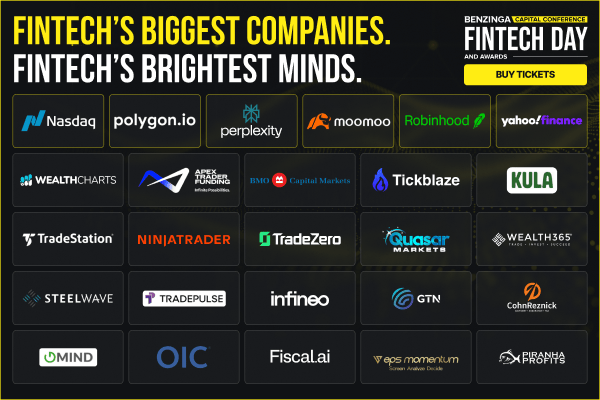

As a loyal reader of Benzinga’s Future Finance newsletter, use your discount to join the industry’s sharpest minds and boldest voices at Benzinga's Fintech Day & Awards on November 10th.

Get your ticket to connect with the most influential names in fintech and:

Network with founders, investors and disruptors

Learn from the top minds in crypto, AI, DeFi and embedded finance

Celebrate excellence and innovation during the awards ceremony

🎟️ Limited seating is available! Secure your ticket now, use code “ZINGER20” at checkout. Future Finance subscribers who purchase a ticket will get early access to our networking app.

FINTECH FOCUS

JPMorgan Chase & Co. has tokenized a private-equity fund on its blockchain platform for wealthy clients, marking a key milestone in its push to digitize alternative investments.

The bank said on Thursday that its new tokenized fund is available to select private-bank clients ahead of next year’s full rollout of its Kinexys Fund Flow platform.

The system converts fund ownership into digital tokens recorded on JPMorgan’s private blockchain, simplifying transfers and settlement as per WSJ.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Ring The Bell: Created for market enthusiasts by market enthusiasts, this daily newsletter delivers top stories, fast movers and hot trade ideas straight to your inbox. Subscribe here.

Advisor: Tailor-made for Financial Advisors, this weekly newsletter has industry-specific insights, analysis and news. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets and mind-blowing tech trends. Subscribe here.