- Benzinga Future Finance

- Posts

- 🚨 Michael Saylor Makes A Wild Claim

🚨 Michael Saylor Makes A Wild Claim

Plus, looking into Trump's new (most likely) Fed Chair.

Happy Wednesday!

Michael Saylor said that Bitcoin is bigger than the US Navy and Google ‘combined’ — what did he mean by that?

Kevin Hassett has become the clear front-runner as next Fed Chair nominee: here’s what his nomination would mean for markets.

Plus, time is running out! Unlock daily trade setups, insider stock picks, and real-time alerts with Benzinga Edge — now 75% off.

TOP STORY

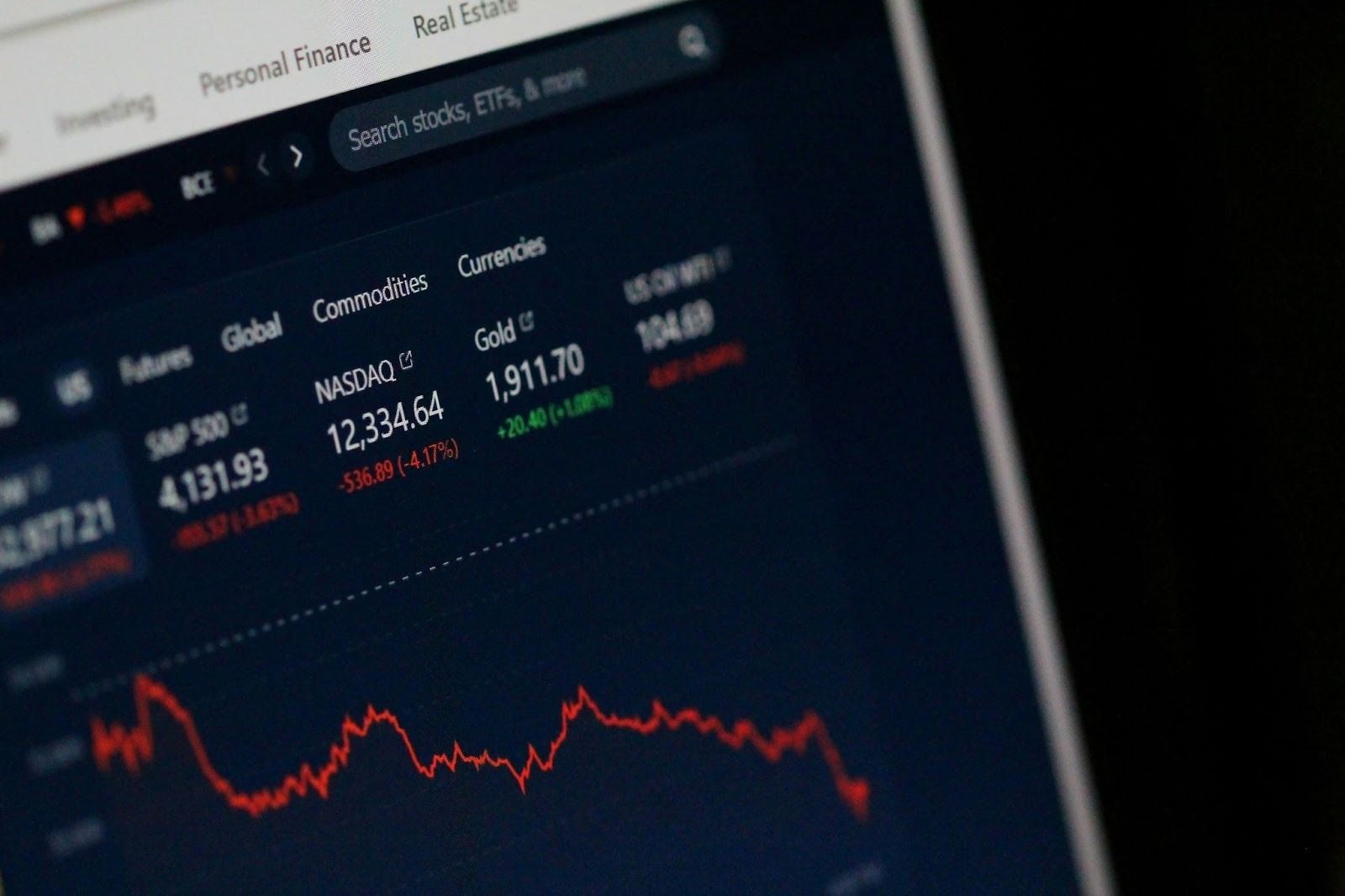

Bitcoin gained fresh attention on Wednesday after Strategy executive chairman Michael Saylor said the asset now consumes more power than the U.S. Navy and the combined infrastructure of Microsoft and Google.

Speaking at Binance Blockchain Week, Saylor said Bitcoin’s rise from speculative instrument to “digital capital” accelerated once President Donald Trump positioned himself as the “Bitcoin president” and appointed crypto-friendly officials across the federal government.

SPECIAL OFFER

Time is running out! Unlock daily trade setups, insider stock picks, and real-time alerts with Benzinga Edge — now 75% off.

QUICK N DIRTY

Bitcoin, Ethereum, Dogecoin, XRP are climbing the wall of worry again, with BTC tapping $93,000 in the morning: here’s what’s driving markets today.

Gary Gensler has resurfaced with a warning we have heard before: don’t trust the crypto expansion, it remains a speculative and volatile sector.

Strategy is in it for the long run, says its CEO Fong Lee: ‘we are not traders, we are investors.’

FINTECH FOCUS

Kevin Hassett has emerged as the leading candidate to replace Federal Reserve Chair Jerome Powell, signaling a potential shift toward sharply easier monetary policy next year.

Hassett, currently serving as Director of the National Economic Council, holds an 80% probability of becoming the next Fed Chair based on prediction market data from Kalshi as of Dec. 2.

He is known for a supply-side philosophy that argues the inflation battle is effectively won and that maintaining restrictive policy amounts to unnecessary economic drag.

His public comments throughout 2024 and 2025 reveal a consistent push for lower interest rates.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Ring The Bell: Created for market enthusiasts by market enthusiasts, this daily newsletter delivers top stories, fast movers and hot trade ideas straight to your inbox. Subscribe here.

Advisor: Tailor-made for Financial Advisors, this weekly newsletter has industry-specific insights, analysis and news. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets and mind-blowing tech trends. Subscribe here.